A contractor submitted the following dual overhead pricing example to us:

Dual Overhead pricing method:

- We have our own Multipliers we use on Material and Labor for overhead.

- Then we add in our finance and commission percentages.

- Then we put our desired net margin on it.

- 10% Finance Fee Built into the margin (If it is more or less, it will be accounted for on the backend only) Not part of our pricing model.

- 10% Commission Built into the margin

- 25% Net Margin Desired

$8,163.64 Total Selling Price at Desired Margins. (Salesman allowed to give up to 15% on their own)

Figures 1 and 2 illustrate the components of the Dual Overhead Pricing Method employed by this contractor.

Figure 1. Contractor Submitted Example.

| Cost | Multiplier or Divisor | Result | |

| Material Cost Overhead | $2500 | * 1.1 | $2750 |

| Labor Cost estimate Overhead | $500 x 3.48 | * 3.48 | $1740 |

| Total Cost with overhead | $4490 | ||

| Apply desired net margin - 45% (10% Finance,10% Commission, 25% Net Margin): | |||

| Sale Price (Total Cost with overhead / .55) | $4490 | /.55 | $8163 |

Figure 2. Dual Overhead Method Calculations

| Dual Overhead Method Calculations | |||

| Labor Part | Material Part | ||

| Material | $ 2,500 | $ - | $ 2,500 |

| Markup (*) | 1.1 | 1.1 | 1.1 |

| Material After markup | $ 2,750 | $ - | $ 2,750 |

| Labor/hr. | $ 35 | $ 35 | $ 35 |

| hours ($500/$35/hr) |

14.28 hrs. |

||

| Labor | $ 500 | $ 500 | $ - |

| Markup | 3.48 | 3.48 | 3.48 |

| Labor after markup | $ 1,740 | $ 1,740 | $ - |

| Subtotal | $ 4,490 | $ 1,740 | $ 2,750 |

| Apply Margin 45% | subtotal/(1-.45) | subtotal/(1-.45) | subtotal/(1-.45) |

| Price | $ 8,163.64 | $ 3,163.64 | $ 5,000.00 |

| Markup Calculations for Sales Builder Pro | |||

|

Material Markup |

$5000/$2500= 2.0 | ||

| Labor Markup | $ 3163.64/500 = 6.327 | ||

| Hourly Labor Markup | $35 X 6.327 = $221.45 | ||

Convert to Sales Builder Pro Business Rules:

We can implement the dual overhead as follows:

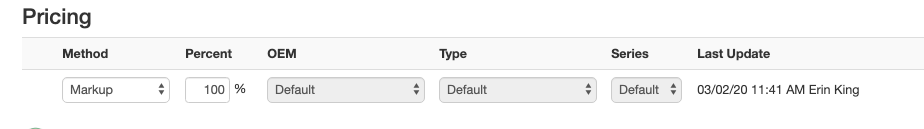

- We combine your material markup (1.1) and Overall margin (45%) to calculate an equivalent business rule for Sales Builder Pro. (1.1/.55). In this case, the math works out to a multiplier of 2.00 (100% Markup). This 100% Markup will apply to materials and labor. (Fig 2 and Fig.3)

- We combine your labor markup (3.48) and Overall margin (45%) to calculate an adjusted labor rate or business rule for Sales Builder Pro. (Fig. 2)

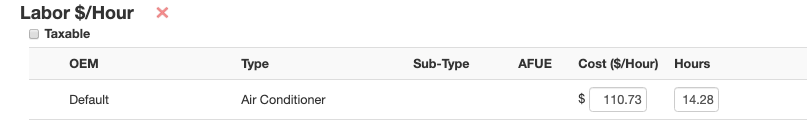

- The provided labor cost was $500. The labor rate per hour is $35/hr. At $35/hr. This works out to 14.28 hours of labor.

- Dual Overhead method applies a multiplier of 3.48 to the cost of labor and then the 45% margin. So the adjusted labor rate is actually 6.327 times the labor cost. The adjusted SBP Hourly Labor Rate Business Rule is $35 x 3.16. SBP will apply a 100% markup to this rate when calculating the sale price. Hourly labor rate would be entered at $110.73 ($35x 3.16). (Fig. 4)

- Manage Margin Pricing Walk illustrates the application of the rules for the sale price calculation. (Fig. 5)

Figure 3. Markup applies to materials and labor

Figure 4. Hourly labor rate rule.

Figure 5. Manage Margin Pricing Walk, Sales Builder Pro Sale Price Calculation.

Comments

0 comments

Please sign in to leave a comment.